Last Updated on May 30, 2022

The following information is from the JAY ASX announcement released on the November 14th 2019:

- $3.5 million capital raised in $3.2 million Placement plus $0.3 million in commitments from board and senior managers to Share Purchase Plan

- Share Purchase Plan at Placement price available to all shareholders to raise an additional estimated $1.5 million for total $5 million capital raising

Jayride Group Limited (ASX:JAY) (“Jayride” or the “Company”) the global online travel marketplace for airport transfers, is pleased to announce that it has completed a placement of 10,672,567 fully paid ordinary shares at $0.30 per share to sophisticated investors to raise $3.2 million (“Placement”), plus $0.3 million in commitments from board and senior managers to the Share Purchase Plan (“SPP”). Shareholders are offered the opportunity to participate in the SPP to raise an additional estimated $1.5 million.

Highlights

- Jayride undertakes a Placement and SPP to raise an estimated $5 million

- Placement has raised $3.2 million and was heavily subscribed with strong support from new and existing institutional and sophisticated investors

- Placement supported by high-quality institutional investors including Thorney Investment Group which will hold over 5% of the Company

- Share Purchase Plan at the Placement price with $0.3 million in commitments from the Chairman, Managing Director, Non-Executive Directors and senior managers to raise an additional estimated $1.5 million

- Jayride now well funded on a high-growth path to profitability, with funds raised through the Placement and SPP to improve Jayride traveller experience at scale, and to provide necessary working capital required to further grow the Company

- Jayride seeks to expand its board with new skills in scaling global travel platforms

Taylor Collison acted as Lead Manager to the Placement, which was well supported by new and existing shareholders.

2,783,161 Placement Shares will be issued under the Company’s Listing Rule 7.1 capacity and 7,889,406 Placement Shares under its Listing Rule 7.1A capacity. Settlement of the Placement is scheduled to occur on Wednesday 20th November 2019 and quotation of the new shares is expected to commence on that date.

Share Purchase Plan

In order to give existing shareholders an opportunity to invest at the same price as the Placement, the Company will offer shareholders the right to participate in a Share Purchase Plan (“SPP”). The SPP gives eligible shareholders the opportunity to purchase shares in the Company without brokerage or other related charges.

The record date to participate in the SPP is 13th November 2019. Shareholders who hold JAY shares and are registered on the record date will be able to participate in the SPP.

The Offer price is at the Placement price of $0.30 per Share. Shareholders can purchase shares totalling up to $30,000 (in any twelve-month period). Shares issued under the SPP will rank equally with existing shares.

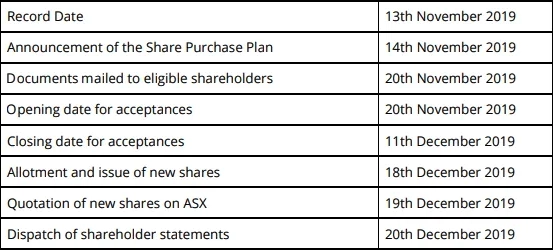

Indicative Dates for Share Purchase Plan*

Top-Up of SPP

To assist the Company in meeting its estimate of additional $1.5 million raised under the SPP, the Company may consider to top-up the SPP with a placement at the SPP price, following the AGM to be conducted on 29th November 2019.

Read the full announcement here: ASX